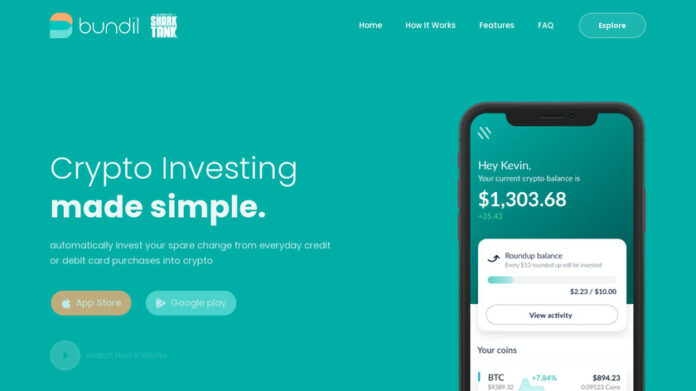

Best Bundil Alternatives will be discussed in this article. Use of the Bundil platform on mobile devices allows for Bitcoin investing. The technology makes it simple to invest automatically in bitcoins. Investing once or creating a regular plan are your options. This functionality allows you to invest in cryptocurrencies even in cases where purchasing a whole share would be prohibitively expensive. It can be used to monitor the return on your Bitcoin investments and to obtain professional financial advice.

You can contact customer service by voice calls, in-app messages, and email. Among other things, it offers automated investments, fractional shares, educational resources, portfolio management tools, and a focus on security and customer service in an effort to make investing in Bitcoin simple and accessible for those who have never done it before.

Features

- Mechanized Investing

- Features of Security

- Options for Customer Service

- Portfolio Management

Top 6 Best Bundil Alternatives In 2023

In this article, you can know about Bundil Alternatives here are the details below;

1. Raiz Invest

You can invest your spare change in an exchange-traded fund (ETF) portfolio using the Raiz Invest platform. It monitors the performance of your investments and provides you with constructive criticism and recommendations. Reinvestments can be scheduled for each day, week, or month to ensure a steady growth of your portfolio over time. You can get paid money through its referral program if you tell your friends and family about it.

2. ChangEd

The ChangEd platform is designed to facilitate students’ prompt loan repayment. You can pay a set amount each month toward the principle in addition to rounding up. Your purchases will automatically be rounded to the nearest dollar thanks to a sync with your bank account. One way to apply the extra funds to your student loans is as follows. It provides you with resources, such as a debt payback calculator, to assist you in monitoring and managing. Also check Adobe Acrobat Alternatives

3. Digit

Digit is an application designed to help you manage and save money. This checking account offers free cash withdrawals from more than 55,000 ATMs nationwide, no minimum balance requirements, and no monthly fees. Additionally, it offers a feature called “Digit Investing” that enables you to invest in low-risk bonds and stocks. Digit will cover the cost if, in an attempt to save you money, you wind up with an overdraft on your account.

4. Stash

Stash is a software that allows users to manage their finances, bank, and invest all in one location. Through the platform, users can invest in bonds, equities, ETFs, and other securities. Users’ money and information are as safe here as they would be at a bank. You can contact customer support within the app through phone, email, or live chat. Debit cards like Stash have an exclusive rewards scheme. Rather than receiving money back at specific.

5. Cred

The financial technology company CRED is based in the Indian city of Bangalore. You can use it to pay for anything, from your monthly rent to your credit card bills. It’s a central place to check your credit score and handle multiple credit cards quickly. The CRED app has several features that let users keep track of their spending and learn how to make the most of their credit cards. This included the capability to monitor.

6. PayPal

PayPal is one of the great and highly trusted money apps and mobile wallets that delivers one of the easiest methods to pay, move money, manage bitcoin, and do much else. It’s a simple and secure money app that enables you transfer and request money from your friends, family members, and other account holders. This application enables you check the PayPal activity, manage your transactions, choose currencies to send around the globe, and more. Also check Helpkidzlearn Alternatives